[Australia Tax Return 2025] How to Link MyGov with ATO – Full Step-by-Step Guide

- Alison Tao

- Jun 16, 2025

- 6 min read

1. Introduction: Why Link MyGov with the ATO?

The official tax season in Australia runs from July 1 to October 31 each year. If you choose to lodge your tax return online, the MyGov platform is your primary access point for managing your tax affairs.

To make the process faster, more accurate, and more convenient, it’s recommended to link your MyGov account with the ATO (Australian Taxation Office) ahead of time.

Once linked, you’ll be able to access the ATO’s pre-fill feature, which automatically imports key tax-related information, including:

Salary and wage details reported by your employer

Interest income from your bank accounts

Government payments (e.g. JobSeeker, Family Tax Benefit)

Superannuation contributions and account balances

This not only saves you time from manually entering data, but also reduces the

chances of making errors, helping you complete your tax return more easily and accurately.

2. What Are MyGov and ATO? What’s the Difference?

MyGov is an integrated online platform provided by the Australian Government. With just one login, you can securely access a range of government services, including:

ATO (tax and superannuation services)

Medicare (universal healthcare)

Centrelink (social security and welfare)

My Health Record (digital health summary)

And other government services

The ATO (Australian Taxation Office) is the federal government agency responsible for managing Australia’s tax system. Its main duties include:

Processing individual and business tax returns

Managing tax payments and issuing refunds

Overseeing superannuation (retirement funds)

Managing student loans (HELP debts)

After linking your ATO account through MyGov, you’ll be able to:

Use myTax to lodge your tax return online

Track your refund status

View your super balance and contributions

Manage your student loan and other tax-related records

3. What You Must Prepare Before Linking MyGov with ATO

To verify your identity during the linking process, you will be asked to answer any two of the following verification questions. It’s best to have the following details ready in advance:

Bank account details: The account you’ve nominated for your tax refund (BSB + Account Number).

PAYG summary or income statement: Obtainable from your employer, accountant, or directly from ATO.

Superannuation fund details: Fund name and your membership number.

Government payments: Records of payments received via Centrelink.

Student loan (HELP or HECS) balance and details.

Reference number from an ATO letter (e.g., Notice of Assessment).

🔹 If you're unable to pass the identity verification, you can call ATO via mobile to

request a Linking Code. Once you receive the code, simply enter it into MyGov to complete the linking process.

4. Step-by-Step Guide: How to Apply & Link

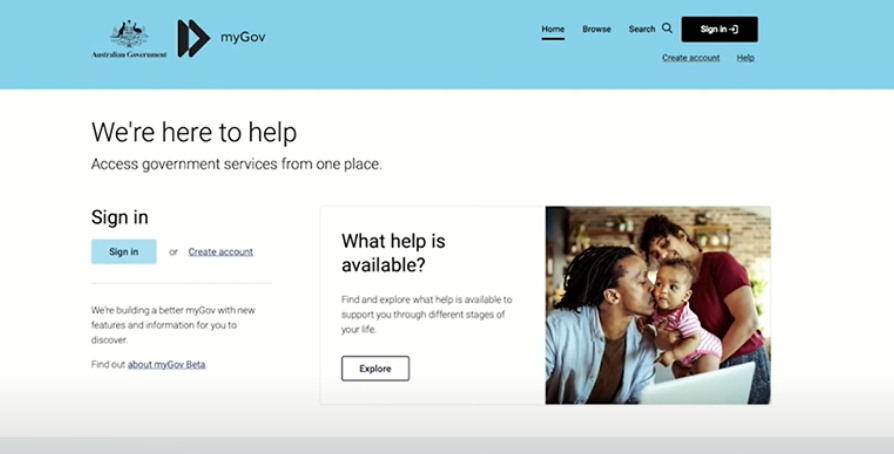

Step 1: Create or Log into Your MyGov Account Go to my.gov.au → Click “Create account” → Verify using email and SMS → Set up your password and security questions.

If you already have an account, ensure you're logging in with myGovID, a Code Generator, or Passkey. Login using only a “secret question” will not allow ATO linking.

Step 2: Link the ATO via MyGov After logging in, click “View and link services” → Select “Australian Taxation Office” → Click “Link”.

Step 3: Enter Personal Details and Answer Verification Questions You’ll be asked to provide your full name, date of birth, address, and Tax File Number (TFN). Then, answer 2 identity questions based on the information you’ve prepared (e.g., bank account, super, NOA).

Step 4: Can’t Verify? Request a Linking Code If identity verification fails, select “Use a linking code”. Call ATO at 13 28 61 to request the code. Provide your personal information (name, TFN, date of birth, super details, etc.). The linking code is typically valid for 24 hours.

Step 5: Enter the Linking Code Return to MyGov and enter the code you received → Once verified, the linking process is complete.

5. What Can You Do After Linking?

Once successfully linked, you’ll gain full access to your tax records and reporting tools. You can:

🔹 Automatically import income and financial details (Pre-fill feature) This feature allows the system to load information from government departments such as:

Employer-provided Income Statements

Bank interest income

Centrelink payments or allowances

Medicare rebate data, HELP/HECS loan details, and more

🔹 File Tax Returns with myTax or the ATO App Using either the built-in myTax tool in MyGov or the official ATO App, you can:

Lodge your return

Track refund status

View and pay tax bills

🔹 Manage other tax and government records Additional features include:

Viewing and managing your Superannuation account

Tracking your student loan balance and repayment status

Reviewing past tax records and future income forecasts

6. What Should You Do Before Lodging Your Tax Return?

To ensure a smooth and timely tax return, here are a few important preparations:

✅ Check and update your personal details in MyGov Ensure your bank details and address are current to avoid refund issues.

⏳ Wait for Pre-fill data to be completed While the tax season starts on July 1, it's better to lodge between late July and mid-October, when most data is available and accurate.

📌 Collect all deductible receipts and records, such as:

Rental income and repair invoices from property owners

Charity donation receipts

Work-related expense receipts (e.g., training, transport)

Medical expenses (if eligible for deductions)

📝 Submit a Non-lodgment Advice if you don’t need to file a return If you have no income or don’t meet the lodging threshold, submit a Non-lodgment Advice via MyGov to avoid being flagged for “non-compliance” by the ATO.

7. FAQ – Frequently Asked Questions

Q: Why can’t I link my ATO account successfully?

A: The most common reason is incorrect information, such as wrong bank account or unmatched year data. Consider requesting a Linking Code via phone or the ATO App for an easier process.

Q: How long is the Linking Code valid?

A: It’s typically valid for 24 hours, so complete the linking as soon as you receive it.

Q: Can I log in to ATO using only a password or secret question?

A: No. You must use one of the following secure methods:

myGovID mobile app

Code Generator (e.g., SMS or authentication app)

Passkey

Q: Can I get help lodging my tax return?

A: Absolutely! There are free and professional support options:

Tax Help Program: For individuals earning under $60,000

National Tax Clinics: Run in collaboration with universities

Registered Tax Agents: For those with complex tax needs (e.g., investments, foreign income, business owners)

8. Video Demonstration

For a visual guide, check out this detailed tutorial: 👉

Conclusion

Successfully linking your MyGov and ATO accounts is the essential first step to filing your 2025 tax return. With proper preparation of verification details and supporting documents, you’ll be ready to lodge your return as early as late July — and receive your refund sooner!

If you run into issues, don’t worry — the ATO App, Tax Help, and professional accountants are all there to support you and make the process hassle-free.

Alison’s Story

Born in Hong Kong an moved to Australia, I have been associated with real estate all my life. As the plane slowly landed on the runway of Melbourne Airport, my life and career also changed to another runway. I changed from a Hong Kong real estate agent to an Australian real estate agent, and successfully obtained the Australian lawyer qualification.

When I was working in a law firm, I was surrounded by highly educated professionals. Even though their wages are very well, and they are absolutely the elites in society, but their lives are full of hard labor, and it’s hard for them to get rich through buying properties.

So I spend all my time and effort on learning financial and real estate investment knowledge, hoping to achieve financial freedom as soon as possible, and let my parents who have worked hard for many years live a good life.

Now I will share with you the knowledge and experience of investing in Australian real estate, and embark on the road to financial freedom together.

Alison Australian real estate information platform

The original intention of Miss Alison to establish investwithalison.com is to provide neutral Australian real estate information through this platform and help investors establish the most suitable investment strategy.

👉Website: investwithalison.com

👉Email: hello@investwithalison.com